Irs 401k Limits 2025 Over 50

Irs 401k Limits 2025 Over 50. There is a higher 401(k) contribution limit for 2025. Although previously delayed, in 2025, individuals who inherited an ira from someone who died on or after jan.

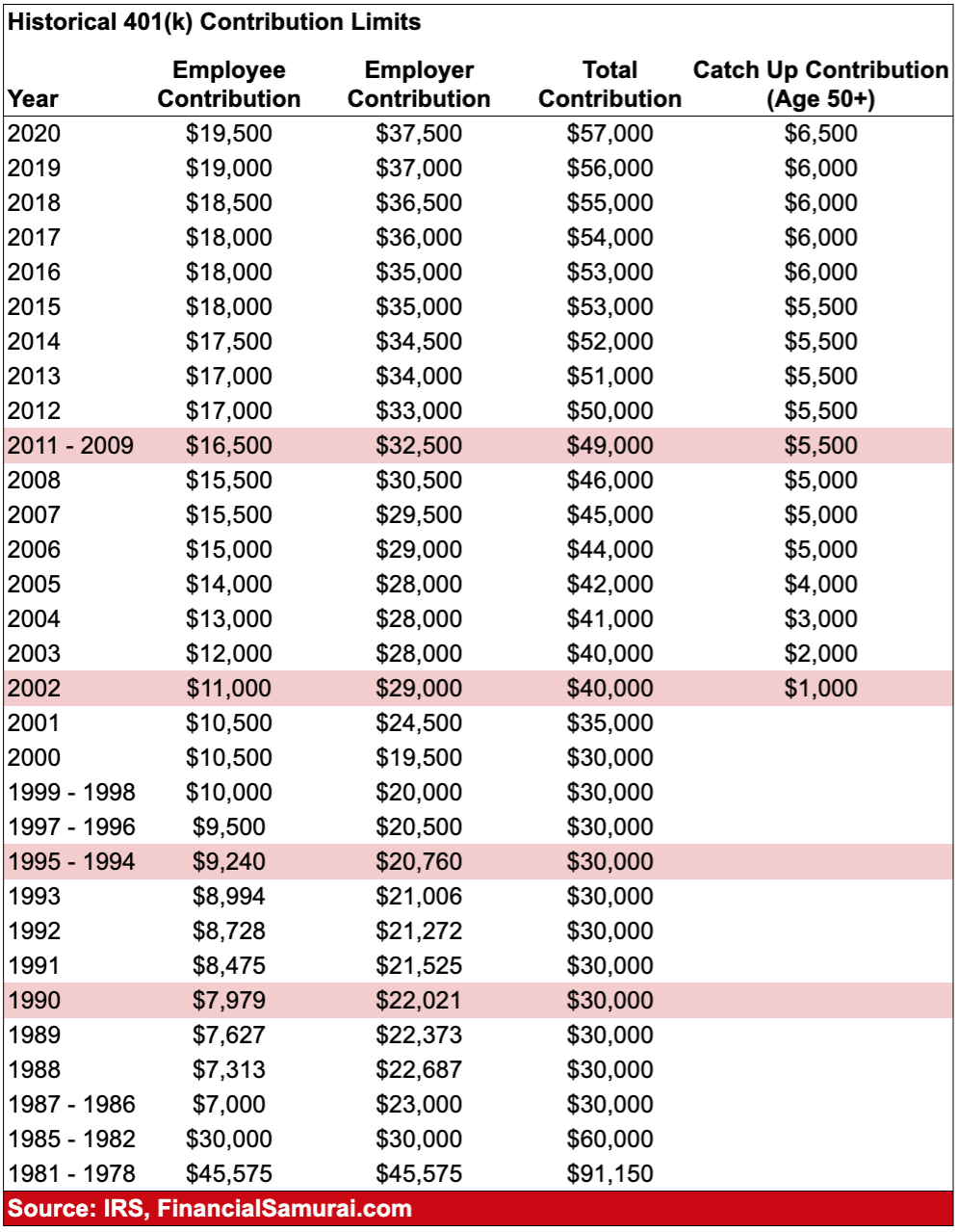

The annual individual limit applies to contributions to traditional and roth iras. The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up.

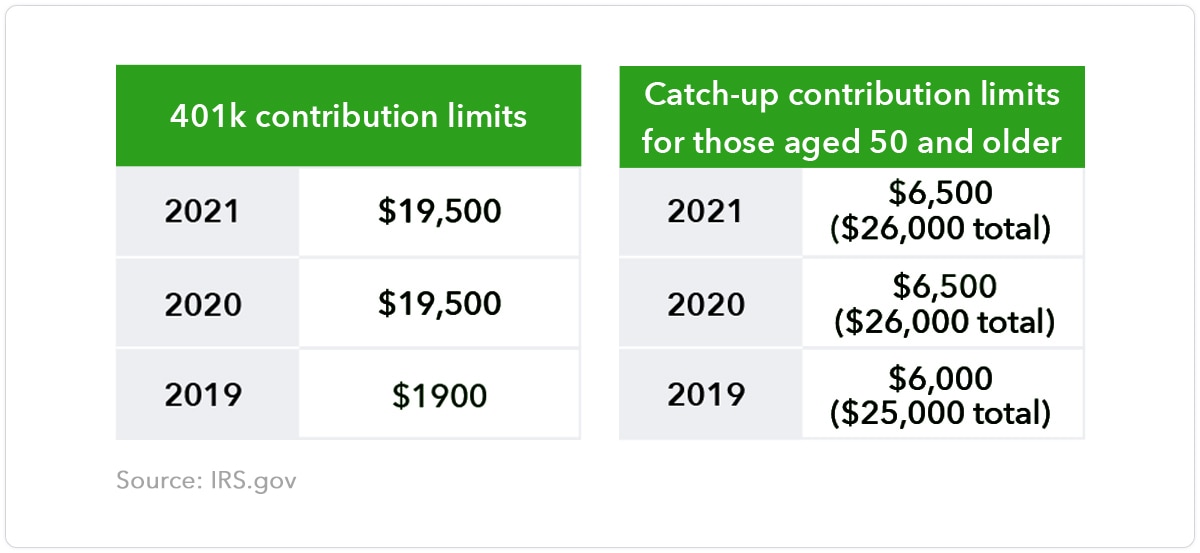

2025 401k Contribution Limits 2025 Over 50 Molly Lewis, Employee contribution limits go up $500 more in 2025, to $23,500 from $23,000.

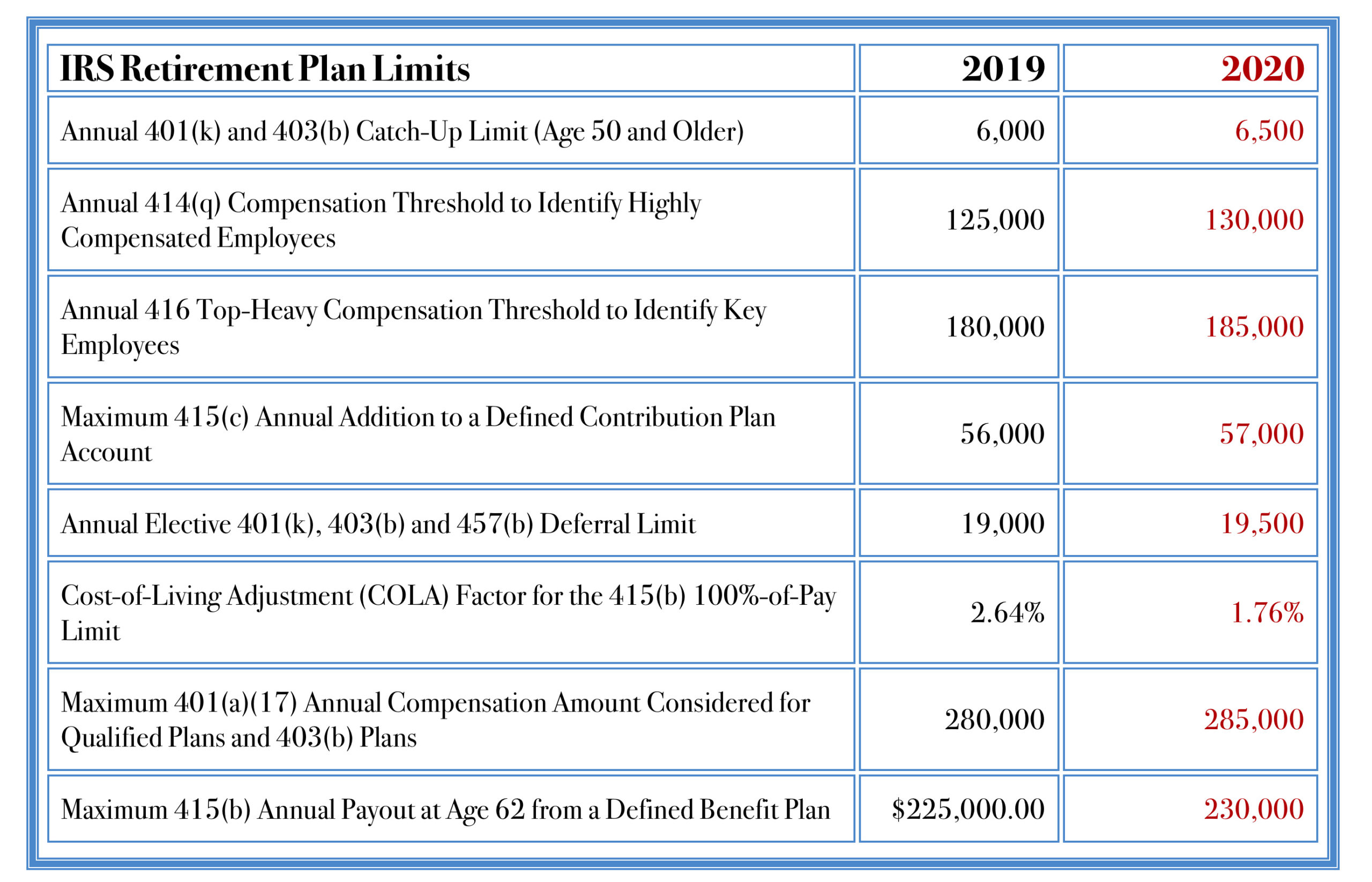

What Is The 401k Limit For 2025 Over 50 Ella Walker, Until then, here are the limits for 2025 retirement plan contributions.

401k Limits 2025 Over 50 Catch Up Phil Hamilton, Key changes for 2025 retirement plan contribution limits.

2025 401k Contribution Limit Age 50 Katherine Dyer, Employee 401(k) contribution limits for 2025.

Ira Limits 2025 Over 50 Rubi Wileen, Until then, here are the limits for 2025 retirement plan contributions.

2025 401k Contributions Over 50 Wendy Lambert, Starting in 2025, employees can contribute up to $23,500 into their 401 (k) and 403 (b) plans, most 457 plans, and the thrift savings plan for federal employees, the irs announced nov.

401k 2025 Contribution Catch Up Limit Irs Andrew Nash, This limit applies to all types of iras.

401k Limit 2025 Over 55 Maura Sherrie, In 2025, the combined limit for employee and employer contributions will be $70,000 or 100% of the employee's salary, whichever is lower.

Irs Annual Compensation Limit 2025 Nicky Evangeline, Until then, here are the limits for 2025 retirement plan contributions.

401k Maximum Contribution 2025 Plus Catch Up Piers Piper, This limit applies to all types of iras.