What Tax Bracket Am I In 2025 With Dependents

What Tax Bracket Am I In 2025 With Dependents. 10%, 12%, 22%, 24%, 32%, 35% and 37%. The highest earners fall into the 37% range, while those who.

Remember, these aren’t the amounts you file for your tax return, but rather the amount of tax you’re going to pay starting january 1, 2025 to december 31, 2025. Single, married filing jointly, married filing separately, or head of household.

Tax Calculator 2025 With Dependents Angy Belinda, As your income goes up, the tax rate on the next layer of income is higher.

What Are The Tax Brackets For 2025 And 2025 Leese, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Compare 2025 Tax Brackets With Previous Years Mela Stormi, Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

Tax Brackets 2025 Head Of Household Ange Maggie, Single, married filing jointly, married filing separately, or head of household.

Tax Brackets 2025 Single Taxable Vera Malena, Based on your annual taxable income and filing status, your tax bracket.

Compare 2025 Tax Brackets With Previous Years Mela Stormi, Single, married filing jointly or qualifying widow (er), married filing separately and head of household.

Estimated 2025 Irs Tax Return Chart Cherie Fernande, Single, married filing jointly, married filing separately, or head of household.

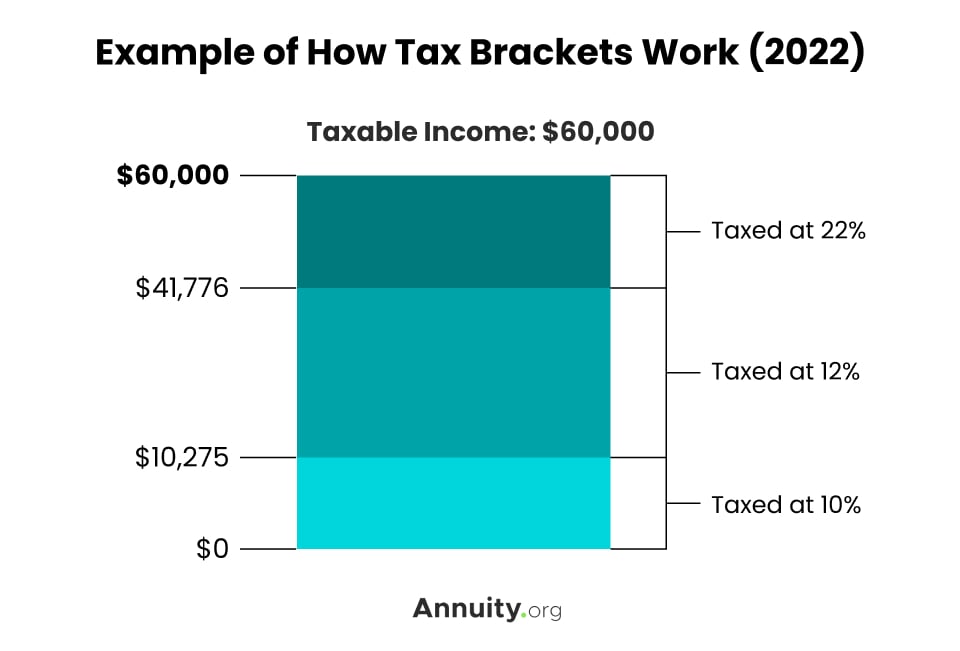

Irs Tax Brackets 2025 Chart Fran Melantha, You pay tax as a percentage of your income in layers called tax brackets.

What Are 2025 Tax Brackets Rahal Carmella, Your tax bracket depends on your taxable income and your filing status: